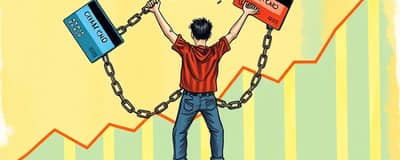

Your credit score is more than just a number; it’s a reflection of your financial reputation. Understanding how it works and learning to optimize it can open doors to lower interest rates, better loan approvals, and long-term stability.

Understanding Your Credit Score

A credit score is a numerical rating of creditworthiness, typically falling between 300 and 850. It predicts the likelihood of repaying borrowed money on time, serving as a snapshot of your financial reliability.

Major lenders, landlords, insurers, and even some employers review this score. A strong number signals low risk, while a weak score can limit your opportunities or increase costs across loans, insurance, and rentals.

How Your Credit Score Is Calculated

Two primary models, FICO® and VantageScore®, analyze data from Experian, Equifax, and TransUnion. Though methods vary, both weigh key factors that influence your final score.

Bankruptcies, loan defaults, and collections can remain on your report for 7–10 years, dragging down your rating long after the event.

Why a Strong Credit Score Matters

Maintaining a robust credit score can transform your financial journey. From securing lower rates to improving rental approval odds, benefits are far-reaching.

- Access to credit: Easier approvals for mortgages, auto loans, and credit cards.

- Lower interest rates that help dramatically reduce borrowing costs.

- Better insurance premiums and reduced security deposits.

- Competitive rental applications with landlords.

- Expanded access to premium credit cards and rewards programs.

Practical Strategies to Strengthen Your Score

Improving your credit is a marathon, not a sprint. Adopting consistent habits can yield significant gains over time.

- Always pay bills on time. Late payments can harm your score immediately.

- Keep credit card balances low—under 30% of available limits.

- Avoid opening multiple new accounts in a short period.

- Maintain older accounts; length of credit history matters.

- Diversify your credit mix with manageable loans and cards.

- Check your credit report annually to dispute any inaccuracies.

- Set up automatic payments or reminders to prevent missed due dates.

- Pay more than the minimum to reduce overall debt faster.

- Monitor for identity theft and fraudulent activity.

Credit Score Ranges Demystified

Credit bureaus typically score between 300 and 850. Understanding each tier helps you set realistic goals.

- Excellent (800–850): Top-tier privileges and lowest rates.

- Very Good (740–799): Competitive rates and solid approval odds.

- Good (670–739): Decent credit access with moderate rates.

- Fair (580–669): Limited options, higher borrowing costs.

- Poor (300–579): Subprime status, highest interest rates, limited credit availability.

Key Takeaways and Moving Forward

Your credit score is dynamic, shifting as new data is reported. By focusing on small, consistent positive behaviors, you can steadily climb the scale.

As you progress, remember that even minor improvements in payment history and utilization can yield significant financial benefits over time. Celebrate milestones along the way—each point increase brings you closer to lower rates and better opportunities.

Begin today: review your credit report, set up automated payments, and adopt at least one new positive habit this week. With dedication and informed action, you’ll unlock the full potential of your financial profile.

Your journey to financial empowerment starts with one smart decision at a time.